The Future of Senior Living: Understanding the Market

The United States has the fewest Senior Living units under construction in 15 years. Meanwhile, we face a “grey tsunami” of demand that has just broken loose with the first Baby Boomers turning 80 in 2025. The wave of new demand will quickly dwarf previous building booms, and it will take years to absorb the imbalance between supply and demand.

In order to better understand the market, let’s explore these topics in detail:

Demographic Destiny

Boomer Wealth

Demographic Destiny

Figure 1: Projection of Americans aged 85 years and older based on U.S. Census Bureau Data. Note the overlap of Baby Boomers and Generation X.

Until now, virtually all Senior Living demand has been driven by the Silent Generation. Now the Baby Boomers (born 1946-1964), about 73 million of them, are entering their senior years, creating a substantial surge in the need for senior housing. Currently, more than 6,400 Americans celebrate their 80th birthday every day. ALL Boomers will be over 65 by 2030. As you can see in Figure 1, the number of them over 80 is already increasing exponentially.[i]

Meanwhile, Covid and macroeconomic factors have made developing new projects extremely difficult. This double-whammy has left our industry in something of a Winter, waiting for the inevitable thaw. But Spring is upon us, with occupancy rates rapidly rebounding, and the macroeconomics pointing to lower interest rates in the future. The race to build for the Boomers has already started. Architects are a leading indicator of sentiment, and our office has seen a marked uptick in new projects. One client remarked to me that it’s about to be the ‘cocaine 80s’ again in Senior Living, referring to a repeat of the boom we experienced from 2010 to 2020.

As powerful as that building boom was, the one brewing now will dwarf it. We need a significant expansion of senior housing options across all levels of care to accommodate the coming hordes of Boomers. Every level of care and every building type is underbuilt. This will be true for at least the next 15 years. The sheer magnitude of the demographic wave ensures long-term and robust demand for senior living. I predict shelter for Seniors will be one of the hottest sectors in Commercial Real Estate. Developers and Operators who start now will be opening their doors in about 2 years, which will be the perfect time. If you design correctly for the Boomers, you’ll be selling water in a desert.

Baby Boomer Wealth

Their generation shapes the U.S. economic landscape, so understanding their financial situation is crucial for anticipating demands on senior living. Their size and relative prosperity have made them the most economically and politically influential cohort in American history. They benefited from strong career trajectories, incentivized housing markets, and booming equity markets during their prime earning years. And wittingly or not, they controlled and instituted policies that advantaged their generation with low interest rates, loan incentives, and cheap consumer goods. In terms of asset ownership, Boomers, as a whole, hold the highest net worth and most assets compared to all other generations past or present. As a result, the average net worth of Boomers is $1,643,000[ii], controlling more than half (52%) of the total invested assets in the United States!

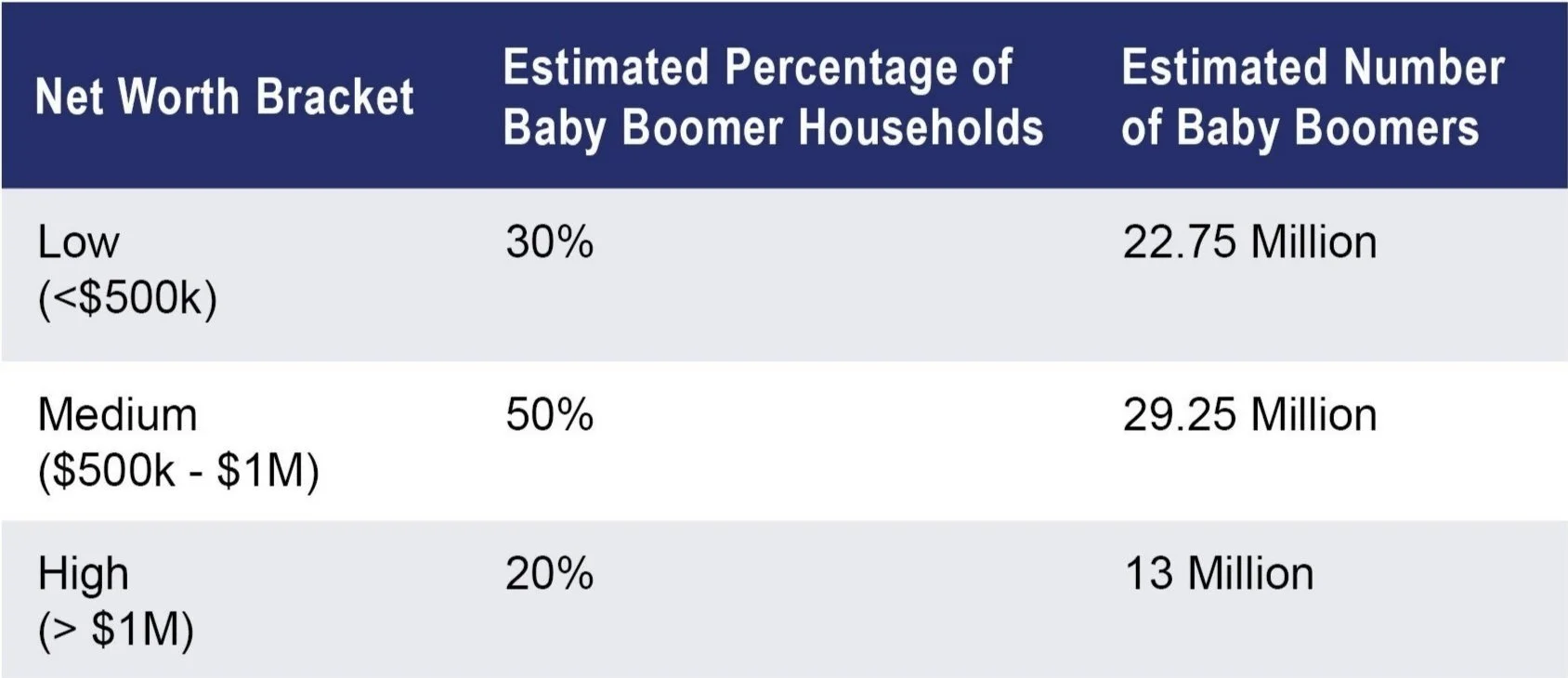

The following table provides an illustrative estimate of the high, medium, and low distributions we are considering:

This distribution underscores the diverse financial realities within the baby boomer generation and has significant implications for their ability to afford senior living and other retirement expenses.

The affordability of senior living with monthly rents of $4,000, $5,000, and $6,000 or more varies significantly across these economic brackets. The average costs of senior living can be substantial, with monthly rents exceeding $4,100 for Independent Living and $6,400 for Assisted Living, the overall average being around $3,353. For baby boomers in the high net worth bracket, these rent levels are likely to be affordable without causing significant financial strain. This segment has the financial capacity to consider a wide range of senior living options, potentially including luxury communities with extensive amenities. Their substantial assets and retirement income provide a strong financial foundation to cover these costs. The situation for those in the medium net worth bracket is more complex. While a monthly rent of $4,000 might be manageable for some, particularly those with significant home equity or robust retirement savings, affording $5,000 or $6,000+ per month could be challenging for many in this group. It might necessitate liquidating assets or relying on a substantial and consistent retirement income stream. Although over 40% of seniors could potentially afford senior housing based on income alone, the specific cost levels they can manage are not detailed. For the low net worth bracket, affording senior living rents at these levels is highly improbable for the vast majority. The average Social Security retirement benefit, which is a primary income source for many in this group, is around $1,900 per month, significantly lower than the target rent levels. Many in this segment rely on Social Security for a large portion of their retirement income, and data suggests half of all seniors cannot afford private senior housing, with only a small percentage able to afford median-priced assisted living. This highlights a significant affordability gap for this segment, making them likely to require financial assistance or seek more affordable housing alternatives. It is important to consider that while baby boomers collectively control a large amount of home equity, many are not planning to use this asset to fund their retirement or senior living expenses, often intending to leave it as an inheritance. This reluctance to tap into home equity further complicates the affordability picture for some. Finally, the cost of senior living varies considerably by geographic location, meaning that affordability in one area may not translate to another with higher costs of living.

The high net worth bracket comprises households with a net worth above $1,000,000. This segment is comprised of about 13 million Boomers who are wealthy and comfortable, possessing substantial assets and diverse investment portfolios. Home ownership rates are high, and they are likely to own properties with significant value, including multiple residences in prime locations. Home equity forms a substantial part of their wealth, although many are already choosing to downsize. Beyond real estate, this group owns businesses and maintains diverse investment portfolios encompassing stocks, bonds, and other financial instruments. They enjoy financial flexibility in retirement, including a wide range of options for housing and care. Post-retirement income also plays a crucial role in their ability to afford Senior Living. Average annual retirement income is estimated to be at least $64,000 using the 4% retirement planning rule[iii], which provides context for the income available to cover living expenses.

The medium net worth bracket is the largest and includes households with a net worth between $500,000 and $1,000,000. This group is financially stable with some accumulated wealth, including home equity and retirement savings. While reasonably secure, they need to carefully consider their financial resources in the face of rising costs and the potential need for long-term care. Home equity typically represents a larger portion of their net worth. But their retirement savings and investments do generate some monthly income.

The low net worth bracket encompasses households with a net worth of less than $500,000. This cohort has limited retirement savings and assets and will experience financial strain in retirement. Over half in this bracket may have less than $250,000 in total assets, including real estate. They will need affordable, but still dignified, housing options with fewer services. The government will almost certainly need to step in to address this by providing additional subsidies to incentivize development. As a result, this cohort is more likely to continue to work into their senior years. Social Security Administration numbers indicate significant proportions of seniors are delaying retirement.[iv]

In conclusion, the financial situation of baby boomers varies significantly but, on the whole, represents a significant concentration of wealth. A large group can afford and will demand high-level senior living with monthly rents of $4,000 or more. Others will have significant reliance on Social Security and subsidized housing options. The senior living industry will need to address the demand in each of these brackets, high, medium, and low, to provide a range of options in the face of rising demand.

This article is the first in a series exploring how the future of senior living will be shaped by rising demand—and how development and design must evolve in response.

Sources:

[i] By 2030, All Baby Boomers Will Be Age 65 or Older

[ii] Which generation has the most wealth? | USAFacts

[iii] https://www.investopedia.com/terms/f/four-percent-rule.asp

[iv] Rising Costs of Living Force Baby Boomers To Rethink Retirement